An authentic democracy is the fruit of a convinced acceptance of the values that inspire democratic procedures:

the dignity of every human person, the respect of human rights, commitment to the common good

as the purpose and guiding criterion for political life.

The Proper Role of Government

It is impossible to understand the role and purpose of government and other social institutions without first appreciating the purpose of life.

If, as the Church believes, the purpose of life is for each soul to search for and find the truth which is God, and to seek to grow closer to God, and to ensure that all other souls are encouraged and enabled to find their own ways to God, it follows that the proper role of government is to provide, with the support of the Church and other moral, educational, and economic institutions, a legal and economic framework in which the common good can flourish, in order that the people may accomplish their mission, that is, so that the people may use the freedom God has given them to seek the truth and thereby return to Him.

An authentic democracy is not merely the result of a formal observation of a set of rules but is the fruit of a convinced acceptance of the values that inspire democratic procedures: the dignity of every human person, the respect of human rights, commitment to the common good as the purpose and guiding criterion for political life. If there is no general consensus on these values, the deepest meaning of democracy is lost and its stability is compromised.

The Church’s social doctrine sees ethical relativism, which maintains that there are no objective or universal criteria for establishing the foundations of a correct hierarchy of values, as one of the greatest threats to modern-day democracies. Compendium of the Social Doctrine of the Church, 407

Institutions and democracy

The Magisterium recognizes the validity of the principle concerning the division of powers in a State: “it is preferable that each power be balanced by other powers and by other spheres of responsibility which keep it within proper bounds. This is the principle of the ‘rule of law’, in which the law is sovereign, and not the arbitrary will of individuals”.

Responsibilities of the State include:

– ensuring that all individuals are enabled to achieve their full potential, by maintaining a framework capable of providing all the material, moral, and spiritual goods necessary for the common good

– harmonizing the different interests of sectors of society with the requirements of justice, including particularly the reconciliation of private ownership of goods with the common good

– ordering society not only in accordance with the desires of the majority, but the effective good of all the members of the community, including minorities

Compendium of the Social Doctrine of the Church, 168

The Role of the Church

The Church does not wish to exercise political power or eliminate the freedom of opinion of Catholics regarding contingent questions. Instead, it intends — as is its proper function — to instruct and illuminate the consciences of the faithful, particularly those involved in political life, so that their actions may always serve the integral promotion of the human person and the common good. The social doctrine of the Church is not an intrusion into the government of individual countries. It is a question of the lay Catholic’s duty to be morally coherent, found within one’s conscience, which is one and indivisible. Compendium of the Social Doctrine of the Church, 571

Taxes & Stewardship of Government

Public administration at any level — national, regional, community — is to be oriented towards the service of citizens, serving as steward of the people’s resources, which it must administer with a view to the common good.

Taxes

Tax revenues and public spending take on crucial economic importance for every civil and political community. The goal to be sought is public financing that is itself capable of becoming an instrument of development and solidarity. Just, efficient and effective public financing will have very positive effects on the economy, because it will encourage employment growth and sustain business and non-profit activities and help to increase the credibility of the State as the guarantor of systems of social insurance and protection that are designed above all to protect the weakest members of society.

Public spending is directed to the common good when certain fundamental principles are observed: the payment of taxes as part of the duty of solidarity; a reasonable and fair application of taxes; precision and integrity in administering and distributing public resources.

In the redistribution of resources, public spending must observe the principles of solidarity, equality and making use of talents. It must also pay greater attention to families, designating an adequate amount of resources for this purpose. In the democratic system, political authority is accountable to the people. Compendium of the Social Doctrine of the Church, 355, 408, 412

Democratic Reform

Representative bodies must be subjected to effective social control. This control can be carried out above all in free elections which allow the selection and change of representatives. The obligation on the part of those elected to give an accounting of their work — which is guaranteed by respecting electoral terms — is a constitutive element of democratic representation.

Among the deformities of the democratic system, political corruption is one of the most serious. If there is no ultimate truth to guide and direct political action, then ideas and convictions can easily be manipulated for reasons of power. A democracy without values easily turns into totalitarianism. Compendium of the Social Doctrine of the Church, 406-412

Cooperation and respect between parties

Political parties have the task of fostering widespread participation and making public responsibilities accessible to all. Political parties are called to interpret the aspirations of civil society, orienting them towards the common good… An authentic democracy is not merely the result of a formal observation of a set of rules but is the fruit of a convinced acceptance of the values that inspire democratic procedures: the dignity of every human person, the respect of human rights, commitment to the common good as the purpose and guiding criterion for political life. If there is no general consensus on these values, the deepest meaning of democracy is lost and its stability is compromised. Compendium of the Social Doctrine of the Church, 407, 413

Subsidiary governments: provinces, municipalities, territories, & Indigenous peoples

The principle of subsidiarity is opposed to various forms of centralization, bureaucratization, and welfare assistance, and to the unjustified and excessive presence of the State in public mechanisms… Just as it is gravely wrong to take from individuals what they can accomplish by their own initiative and industry and give it to the community, so also it is an injustice and at the same time a grave evil and disturbance of right order to assign to a greater and higher association what lesser and subordinate organizations can do. Compendium of the Social Doctrine of the Church, 185

Peace & Good Order

Interprovincial and International Trade

The Church has time and again called attention to aberrations in the system of international trade, which often, owing to protectionist policies, discriminates against products coming from poorer countries and hinders the growth of industrial activity in and the transfer of technology to these countries.

The continuing deterioration in terms of the exchange of raw materials and the widening of the gap between rich and poor countries has prompted the Church to point out the importance of ethical criteria that should form the basis of international economic relations: the pursuit of the common good and the universal destination of goods; equity in trade relationships; and attention to the rights and needs of the poor in policies concerning trade and international cooperation.

Economic and social imbalances in the world of work must be addressed by restoring a just hierarchy of values and placing the human dignity of workers before all else. Compendium of the Social Doctrine of the Church, 370, 321, 364

“Opening up to the world” is an expression that has been co-opted by the economic and financial sector and is now used exclusively of openness to foreign interests or to the freedom of economic powers to invest without obstacles or complications in all countries. Local conflicts and disregard for the common good are exploited by the global economy in order to impose a single cultural model. This culture unifies the world, but divides persons and nations, for “as society becomes ever more globalized, it makes us neighbours, but does not make us brothers.

We are more alone than ever in an increasingly massified world that promotes individual interests and weakens the communitarian dimension of life. Indeed, there are markets where individuals become mere consumers or bystanders. As a rule, the advance of this kind of globalism strengthens the identity of the more powerful, who can protect themselves, but it tends to diminish the identity of the weaker and poorer regions, making them more vulnerable and dependent. In this way, political life becomes increasingly fragile in the face of transnational economic powers that operate with the principle of “divide and conquer”. Pope Francis, Fratelli tutti, 12

Criminal Justice & Public Safety

In order to protect the common good, the lawful public authority must exercise the right and the duty to inflict punishments according to the seriousness of the crimes committed. The State has the twofold responsibility to discourage behaviour that is harmful to human rights and the fundamental norms of civil life, and to repair, through the penal system, the disorder created by criminal activity… Punishment does not serve merely the purpose of defending the public order and guaranteeing the safety of persons; it becomes as well an instrument for the correction of the offender. There is a twofold purpose here. On the one hand, encouraging the reinsertion of the condemned person into society; on the other, fostering a justice that reconciles, a justice capable of restoring harmony in social relationships disrupted by the criminal act committed. Compendium of the Social Doctrine of the Church, 402

Role & Purpose of Government

The party states that:

– New Brunswick is a province of diverse communities – First Nations, Acadian, Anglophone, new Canadians – united in the desire that its children and grandchildren will thrive in the face of global change.

– it believes that the future is rooted in resilient, self-reliant communities, a renewed sense of citizenship, equal opportunities for all citizens, and an ecologically sustainable economy.

In seeking such a society, the party is guided by the following fundamental principles:

– living with the province’s ecological means.

– local self-reliance.

– participatory democracy:

- the cornerstone of any democracy is a media independent of vested and political interests, reflecting the full diversity of New Brunswick society. Without this our province’s full democratic potential cannot be realized.

- new Brunswickers must have meaningful opportunities to participate in the decisions that affect their lives, created through responsive and decentralized democratic processes, structures and institutions.

- enthusiastic participation in elections is contingent on an electoral system in which every vote counts and results in a Legislature that reflects the diversity of political viewpoints of all New Brunswick citizens.

– social justice and equality.

– self-determination and citizenship:

- each person must be granted both the right and opportunity to reach their full potential as autonomous individuals, empowered to assert control over their own circumstances and to assume the responsibility of active citizenship within supportive communities.

- to counter the cynicism and detachment of individuals from the political life of our province, people must be seen as citizens in communities contributing to a common good, not as self-interested consumers in a Consumer Society.

– non-violence:

- the party declares its our commitment to strive for a culture of peace and cooperation between individuals, within communities and in relations between governments and citizens.

- it commits to reducing the vulnerability of women and children to violence by building caring and protective communities.

- it seeks a justice system centered on rehabilitation and reconciliation rather than retribution and revenge.

- it believes that local, national and global security should rest on cooperation, just economic and social structures and relations, ecological security, and vigorous protection of human rights.

These principles are the basis of a just, equitable and sustainable future for our children and our province, and the philosophical foundation on which the policies and platforms of the Parti Vert NB Green Party are built.

Taxes, Services, Stewardship & Reform

Taxes

The party states that:

– in order to adequately fund public services, it advocates a tax system that ensures that everyone – individuals and companies – contributes their fair share.

The party advocates:

– abolishing government funding (grants, loans, tax credits, etc.) to companies that use tax havens to avoid paying taxes in New Brunswick.

– eliminating property tax exemptions on heavy industries.

– a public inquiry into the provincial tax system, including property taxes, off-shore accounts, taxation of large inheritances, estate taxes as well as fiscal policy on the extraction of natural resources.

Reform

The party states that:

– citizens expect and need a democracy that works well, particularly in times of crisis. This means leaving no one behind. It means that everyone’s opinion counts and is valued, but also it means more transparency.

– the provincial system of government needs to be more responsive to citizens.

The party advocates:

– replacing local service districts (LSD) with local municipalities governed by elected councils.

– allowing municipalities to play a greater role in economic development, immigration and tourism.

– implementing a proportional representation voting system to ensure that the Legislature would more closely reflect the popular vote. After two elections, citizens would be asked to decide through a referendum if they wish to keep the voting system or not.

– lowering the legal voting age to 16 years, and incorporating civics and citizenship courses by the 9th grade.

– strengthening the Right to Information and Protection of Privacy Act to increase transparency.

– restoring freedom of the press by prohibiting cross-ownership of media and non-media businesses, and by banning media monopolies.

– requiring any spending proposal not included in the budget to be voted on in the Legislature.

– strengthening the protection of whistleblowers within the civil service.

Role & Purpose of Government

As a principle of its constitution, the party states that:

– it believes that all citizens are entitled to an equal say in the decisions that affect their lives, including the opportunity to participate in originating, developing and debating of policies and legislation, and will proudly act as a vehicle through which members and citizens can voice their opinions and shape public policy in New Brunswick.

– through a commitment to equal opportunity, and a belief in the inherent dignity of all people, it will strive to advance progressive and innovative policies and programs designed to overcome social inequities, whether based on economic or regional factors, age, gender and sexual orientation, ethnic background, or physical or mental ability.

– it stands for full linguistic and cultural equality of those who speak French and those who speak English, and of the equality of the two linguistic communities. These principles will be reflected both in the development of policies and in internal practices.

– it will strive to encourage and enhance multiculturalism in New Brunswick.

– it believes that effective and inclusive social programs contribute to the development of a vibrant economy. Likewise, it recognizes that a strong economy is needed to provide such programs. It will therefore seek innovative and progressive means to ensure the continued development of relevant and responsive social programs, as well as the expansion of employment opportunities for all New Brunswickers.

– it requires the highest standards of moral and ethical conduct from all those who seek and hold political office under its banner.

Democratic Reform

Campaign Finance

In order to maintain the vital integrity of the electoral process, the party advocates updating New Brunswick’s campaign finance laws to prevent provincial political parties from raising money outside the province’s boundaries, ensuring that political funding is transparent and locally sourced.

Citizens Assembly on Electoral Reform

The party states that:

– social legitimacy in electoral reform requires extensive citizen involvement in the design of the system.

– a citizens’ assembly is a respected method of participatory democracy.

The party advocates:

– prioritizing convening of a representative citizens’ assembly on electoral reform with a guaranteed minimum number of Indigenous participants, the assembly to be run by a nonpartisan organization, independent of government direction and interference, tasked with recommending an electoral system for New Brunswick at the provincial level, and proposing a process and timeline for implementation, with potential consideration of municipal level reforms.

– collaborating with other parties in the Legislative Assembly to ensure timely implementation of reforms, and if an incremental approach is adopted, working to maintain momentum beyond the first step.

Restoration of Plebiscites

The party states that:

– the current government removed the right to plebiscites from the Local Governance Act, impacting community engagement and decision-making. Restoring the community right to hold plebiscites on significant matters such as major infrastructure projects, zoning changes, tax increases, and mandates from the Regional Service Commissions is crucial for local democratic participation.

The party advocates:

– restoration of the plebiscite in the Local Governance Act, so as to reinvigorate local democratic processes, increase transparency, and enhance community involvement, including implementing clear criteria, a transparent process, public awareness, and education, and ensuring local governments are responsive to plebiscite outcomes.

Modernized Electoral Process

The party states:

– in recent years, citizens’ confidence in democratic institutions has been declining, presenting significant challenges for provincial leaders. Governments at various levels have struggled to encourage citizens to exercise their right to vote, leading to diminished legitimacy. To preserve our democratic values, it is essential to enhance citizen participation in the electoral process and restore public trust in institutions.

– furthermore, early education on these matters should be integrated into individuals’ educational journeys.

– advances in technology have made voting more accessible, eliminating physical barriers and promoting citizen participation in the electoral process.

– allowing young adults to register to vote would be beneficial.

The party advocates:

– lowering the voting age to 16 in New Brunswick, encouraging the civic engagement of young adults and enabling 16-18 year olds to actively contribute to democracy, promote inclusivity and democratic diversity, and acknowledge young people’s capacity to shape their own future and contribute to society.

Property Taxes

Property Tax Reform

The party states that:

– it acknowledges the concerns and challenges posed by rising property tax assessments on homeowners and businesses, recognizes the need for a balanced approach to property tax assessments that ensures fiscal responsibility without causing undue financial strain on property owners; and recognizes the need for a fair and equitable property tax system that promotes economic stability for municipalities and takes into account the complex nature of property taxes and the need for careful consideration.

The party advocates:

– property tax reform with the following key provisions: (1) fair assessment, (2) exemptions and relief, (3) commercial and industrial property reform, and (4) public engagement, monitoring and adjustment.

– establishing a small representative committee of experts to study options and propose a fairer property tax regime for the future and that the committee’s report include an executive summary that presents the main points in clear and easy-to-understand language.

– working collaboratively with municipalities, stakeholders, community organizations, and experts in tax policy, to ensure successful implementation of this comprehensive property tax reform.

Property Tax Rebate for Seniors

The party states that:

– many seniors living on a fixed income are struggling under the weight of skyrocketing food prices, energy and utility costs, prescription drugs, and more; and increases in pensions are not keeping pace. The median income for seniors living solely on Old Age Security and Guaranteed Income Supplement is around $20,000 each.

– often better quality of life and health outcomes are achieved by keeping seniors in their homes as long as possible. It is most cost-effective for the province to support seniors in their home as long as possible, compared to long-term care or hospitalization.

The party advocates:

– introduction of a policy where seniors under a certain income threshold, upon the registered homeowner reaching the age of 65, would have their property taxes frozen for as long as they continue to reside in said residence, including consideration of a model where seniors could receive an annual rebate of up to 30% of their property tax based on their income, diminishing as income approaches the threshold level.

– upon the seniors moving out of the home, or upon the sale or transfer of the property, the property tax freeze would no longer apply.

Municipal-Provincial Property Tax Reform

The party states that:

– the primary source of funding for municipalities comes from property taxes, and increases in property taxes contribute to the rising cost of living.

– the equalization subsidy system aims to address disparities in capacity between municipalities, but the revenues from property taxes as calculated and shared are insufficient to meet the growing needs of municipalities.

– the provincial government has implemented a long-awaited reform of municipal structures and the establishment of Regional Services Commissions without ensuring adequate funding.

– the current main sources of funding for municipalities are inadequate to meet their growing responsibilities.

The party advocates:

– the provincial government assuming the costs related to the operation of the Regional Services Commissions.

– establishing a working group of stakeholders to identify and propose new sources of funding for municipalities, including consideration of a better allocation of HST, cannabis taxes, revenues from police fines, and taxes on gasoline and fuel, thereby reducing the burden on property owners.

Property Tax on Inherited Homes

The party states that:

– many residential properties are bequeathed to children or family members. Residential properties that are not owner-occupied following the death of the parents are subject to double taxation. Double taxation places an undue financial burden on individuals trying to sell an inherited residential property.

– at the same time, whether children or other family members, may face challenges in selling these inherited properties, often taking a significant time to find a buyer.

– in 2020, the Legislative Assembly unanimously passed a motion which has not been implemented by the current government.

The party advocates:

– eliminating double taxation on inherited residential properties for a period of two years from the date of the testator’s death, provided the child or family member does not occupy, rent, or lease the property

Stewardship of Property

The party states that:

– many buildings owned by the provincial government remain vacant for unacceptably long periods. Numerous provincial buildings and lands have been unused for extended periods, often over a decade, with minimal maintenance, diminishing their value. Many could be repurposed into affordable housing.

– holding onto unused land and buildings restricts potential land revenues for municipal and/or provincial governments.

The party advocates:

– developing a clear plan mandating that any provincial building or land becoming vacant or unused be offered to other government departments within 6 months. If no interest is expressed, the government should proceed to put the building or land up for sale using appropriate methods within the subsequent 6 months.

Intergovernmental Relations

Local Empowerment

The party states that:

– local governments are already engaged in land use planning, with plans either in place or under development.

– the effects of climate change require changes in our consumption habits, development plans, and infrastructures. Related loss of nature directly impacts communities and their citizens.

– the consequences of climate change, such as erosion, forest fires, heat or cold waves, air quality issues, and economic impacts, as well as potential solutions, may vary significantly from one community or region to another.

The party advocates:

– adopting a collaborative approach with Indigenous communities, municipalities, Regional Services Commissions, and concerned non-profit organizations to devise local and regional solutions to the effects of climate change and nature loss, with multi-year funding and technical support to local governments and non-profit organizations for environment and climate change-related projects.

Municipal Funding Reform

The party states that:

– the primary source of funding for municipalities comes from property taxes, and increases in property taxes contribute to the rising cost of living.

– the equalization subsidy system aims to address disparities in capacity between municipalities, but the revenues from property taxes as calculated and shared are insufficient to meet the growing needs of municipalities.

– the provincial government has implemented a long-awaited reform of municipal structures and the establishment of Regional Services Commissions without ensuring adequate funding.

– the current main sources of funding for municipalities are inadequate to meet their growing responsibilities.

The party advocates:

– the provincial government assuming the costs related to the operation of the Regional Services Commissions.

– establishing a working group of stakeholders to identify and propose new sources of funding for municipalities, including consideration of a better allocation of HST, cannabis taxes, revenues from police fines, and taxes on gasoline and fuel, thereby reducing the burden on property owners.

Courts & Public Safety

Mental Health Courts

The party states that:

– the Mental Health Court offers an alternative for offenders with mental health issues. It is widely praised by mental health advocates for its focus on community treatment as opposed to incarceration or other sanctions, and was developed based on best practices in other jurisdictions and informed by research. Other provinces, including Nova Scotia, have recognized the benefits of having a Mental Health Court and have made a commitment to expanding availability.

– during a former term in office, the party reinstated the Mental Health Court through the Provincial Court system in Saint John, with plans to expand Mental Health Court Services throughout the province. There exists a need to expand the Mental Health Court program to other regions of the province so that more offenders with mental health issuers can avail themselves of this invaluable service for addressing their mental health needs.

The party advocates:

– comprehensive expansion of the Mental Health Court program across the entire province, including providing the appropriate resources and funding, strategic partnerships, and the implementation of evidence-based practices to ensure the program’s effectiveness in addressing mental health issues within the judicial system.

Role & Purpose of Government

The party has published no current specific statement of its policies concerning the role or purpose of government.

Taxes, Services, Stewardship & Reform

The party states that:

– many New Brunswickers support investments in new social programs, including measures to ensure that everyone lives in a more equitable society—but only if they feel that the tax system is fair. Today it is not.

– it’s time a more progressive provincial income tax and a comprehensive of the provincial property tax system.

The party advocates creation of a Property Tax Commission to review how property taxes are collected, including consulting the public and other stakeholders, and committing to ask the tough questions:

– what is a reasonable and fair share of provincial revenue to be derived from the tax of people’s homes?

– what is a reasonable and fair share for industry to pay on commercial property? Is it fair for commercial properties and apartment buildings to pay double?

– should increases in assessments be tied to the real estate market conditions as they are now, or is there a better way?

– how can the province ensure that the assessment process is free from political interference?

– what is the most fair or equitable way to distribute property tax revenue to municipalities?

Respecting income taxes, the party advocates amending the current tax system as follows:

– reversing the decision to cut taxes for the top 1% of income earners.

– adopting a 16% corporate tax rate—the same as in PEI and Nova Scotia.

– bringing back the Large Corporation Capital Tax.

– increasing the Financial Corporation Capital Tax (‘Bank Tax’) by 2%.

– reviewing royalty rates and updating industrial policies to ensure the people of New Brunswick are getting a fair return on the province’s natural resources.

– ending the energy buyback program through NB Power, which effectively subsidizes large industrial users for using their own electricity.

– ending special tax treatment for industry on forest properties, farmland, petroleum sites and other facilities.

– reviewing the provincial forestry stumpage policy and implementing a new royalty structure.

Courts & Public Safety

The party states that it is committed to:

– expanding professional development opportunities for police officers and judges to learn about the realities of sexual assault and implement formalized emergency response mechanisms that support survivors, based on legislation introduced in Alberta.

– ending all forms of racism and discriminatory practices, including expanding oversight of provincial police and correctional facilities with an emphasis on moving towards a system that reduces recidivism through rehabilitation—rather than profiling and punishment.

Role & Purpose of Government

The party states that:

– it seeks to inspire New Brunswickers to trust their government again, by by prioritizing the people’s needs over political agendas, introducing and promoting sound policies, making common-sense decisions, and working collectively to improve New Brunswick for future generations.

To that end, the party has established five core values defining who it is, what it believes, and how it will act:

– 1. Fiscal Responsibility: for New Brunswick to prosper, those in government must always treat the spending of taxpayer money as if they were spending their own. Today’s debt and deficits become taxes for future generations. One cannot spend one’s way to prosperity, and one cannot cut one’s way there, either. Spending decisions must consider both the short-term and long-term goals and impacts, as well as who will benefit.

– 2. Democracy: the party aspires to govern the province for the people of the province. It believes that the government is employed by the citizens. It’s job is to be the voice of the people in the legislature, not a voice of the legislature to the people. It undertakes to listen to different voices and opinions, gather information, compile data, and determine directions and actions from that.

– 3. Fairness and Equality of Opportunity: the party believes that every New Brunswicker should have an equal opportunity for success and that all citizens of our province should be treated equally. The province should work towards maximizing opportunities and access for everyone.

– 4. Leadership: the party believes that leadership is leading by example. It will never ask New Brunswickers to make sacrifices; they would not make themselves or bestow benefits upon themselves that they would not pass on to everyday people.

– 5. Working Collaboratively: the party recognizes it takes a collaborative effort for the province to succeed. It is willing to work with others to advance New Brunswick’s best interests.

Reform

Electoral Reform

The party advocates an MLA recall process, whereby:

– eighteen months after an election or byelection and until six months before the next general election, an eligible NB voter living in and registered to vote currently and at the time of the last election can apply to recall their MLA by applying to the Chief Electoral Officer for a petition to recall the elected official.

– if the application is approved, a petition will be issued to be used to collect signatures supporting the recall. The petitioner would then have 60 days to gather signatures from 55% of eligible voters in that constituency. The applicant can use volunteers (canvassers) who must also be riding residents to gather the signatures. They may appoint a financial agent and apply for the right to advertise or sponsor a recall initiative.

– once the signatures have been gathered, they will be submitted to the Chief Elector Office, which will validate them and ensure that the threshold has been met.

– if the petition is successful, a recall vote will be held in the riding to determine whether the elected official should be recalled. If the vote succeeds by a simple majority, the official ceases to hold office, and a by-election will be held.

Citizen’s Initiative

The party advocates a citizen’s initiative process whereby:

– any voter registered with Elections NB can apply for a petition to be issued to gather support for a legislative proposal (in the form of a draft bill). A legislative proposal can be regarding any matter within the jurisdiction of the Legislature of New Brunswick.

– to begin an initiative petition, the voter must submit a completed application form to the Chief Electoral Officer along with a $100 processing fee and a copy of the proposed law as a draft Bill.

– if the application meets the legislative requirements, the Chief Electoral Officer approves the initiative petition in principle, and the petition is issued to the applicant (called a “proponent”) 60 days later. The proponent then has 90 days to collect the signatures of 20% of the registered voters in each electoral district. Volunteers may help the proponent when canvassing for signatures.

– once petition sheets are submitted, the Chief Electoral Officer has 45 days to verify that enough valid signatures have been collected. If the verification process shows that sufficient signatures have been collected and the proponent has met the financing requirements, the Chief Electoral Officer sends a copy of the petition and draft Bill to a Select Standing Committee of the Legislature.

– the Select Standing Committee on Legislative Initiatives must meet within 30 days of receiving the initiative petition and has 90 days to consider the legislative proposal. The Committee must either table a report recommending the introduction of the draft Bill or refer the initiative petition and draft Bill to the Chief Electoral Officer for an initiative vote.

– suppose an initiative petition has met the signature threshold and financing requirements and has been referred to the Chief Electoral Officer for an initiative vote by the Select Standing Committee. The vote must be conducted on a fixed schedule according to the Recall and Initiative Act. No vote will be held if no initiatives have been referred to the Chief Electoral Officer.

– if more than 50% of the total number of registered voters in the province vote in favor of an initiative, and more than 50% of the total number of registered voters in each of at least 2/3 of the electoral districts in the province vote in favor of an initiative, the Chief Electoral Officer must declare the initiative vote to be successful. The government must introduce the Bill at the earliest practicable opportunity.

– after a Bill is introduced into the legislature, the requirements of the Recall and Initiative Act have been satisfied, and any subsequent reading, amendment, or passage of the Bill will proceed as with any other Bill, with no guarantee of passage.

Role & Purpose of Government

The party’s constitution states that the party believes in:

– 1. The Will of People: that government is an extension of the will of the people; therefore, it must answer to the people for the responsibilities, which it accepts. It will consult New Brunswickers on public policy matters before implementing solutions.

– 2. New Brunswick and Canada: it strives to build and preserve a prosperous, united New Brunswick within a prosperous, united Canada.

– 3. Equality of the Two Linguistic Communities: it believes the diversity of our two linguistic communities is a unique strength of the province. It believes in official bilingualism, and that it must protect and promote the cultures and heritage, while treating each community with fairness and justice.

– 4. The Individual: it respects the rights of the individual, but is mindful of the responsibilities, which those rights demand. It is by accepting their responsibility and acting on their own initiatives that individuals will achieve their full potential.

– 5. Free Enterprise: the creation of prosperity can best be achieved by a free enterprise economy.

– 6. Living Within Our Means: as manager of the public accounts, government must fulfill its fiscal and economic objectives; a diversified economy that will maximize employment in all regions and a fiscal plan that will protect essential programs while minimizing taxation.

– 7. Access to Education and Health Care: the strength of New Brunswick is derived from the ability of the province to educate its citizens and to encourage a healthy lifestyle so that they may fulfill their potential and by our ability to provide care for New Brunswickers when they are in need.

– 8. Social Policies Which Promote Individual Responsibility: provincial social programs should ensure dignified and meaningful lives for those who need assistance, but also recognize the importance of providing the support and resources necessary for an environment in which New Brunswickers can work together, be self-reliant and take responsibility for their own lives.

– 9. Protection of the Environment: the province must ensure that economic growth and resource development take place in an environmentally sustainable manner, and that decisions taken reflect the shared role of government, business and individuals as stewards of the environment for the current and future generations.

– 10. An Open, Accessible Party: it is a Party for all New Brunswickers. it welcomes their thoughts, their efforts and their support for the aims and principles of the party.

Prior to its current term in office, the party further stated that:

– to serve New Brunswick is an honour like no other. Every day, it is continually impressed by the resilience and perseverance of the people of New Brunswick.

– it said long ago that New Brunswick must do politics differently. That means putting the priorities of New Brunswickers ahead of political self-interest. The province must think long-term and create policies that will extend beyond one government’s mandate, to ensure the province’s success for years to come.

Taxes, Services, Stewardship & Reform

Fiscal Responsibility

The party states that prior to its current term in office:

– it improved the provincial credit rating from negative to stable, meaning that the province pays less interest, and investors are more confident in doing business in New Brunswick.

– it reduced WorkSafe premiums for employers, and presented a balanced budget.

Provincial Debt

In its 2024-25 budget, the party states that on a provincial debt of approximately $12.4 billion:

– in 2023-24, it allocated payments of $627 million to serve provincial debt, but required only $542.2 million for that purpose.

– in 2024-25, it has allocated payments of $608 million to service provincial debt.

Budget Surpluses

According to the party’s 2024-25 budget:

– in 2023-24, the party forecast a surplus of $40.3 million, and in the end realized an actual surplus of $247.7 million.

– for 2024-25, it is forecasting a surplus of $40.9 million

Revenue

The party states in its 2024-25 budget that it has projected revenues of $6.499 billion (an increase of 6.5% from $6.131 billion in 2023-24), including:

– $2.44 billion in personal income tax.

– $2.38 billion in harmonized sales tax (HST).

– $690 million ($0.69 billion in corporate income tax.

– $500 million in real property tax.

– $200 million in gasoline and fuels tax.

Legislative Assembly

In its 2024-25 budget, the party states that:

– in the 2023-24 budget year, it spent $33.0 million for operations of the Legislative Assembly.

– in the 2024-25 budget year, it has allocated $47.3 million for operations of the Legislative Assembly.

– the allocations for 2024-25 include an increase of approximately 3% for member’s salaries and allowances.

– the allocations for 2024-25 include an increase of approximately $12.73 for Elections NB, for supervision and administration of all provincial, municipal, rural community, district education council and regional health authority elections, plebiscites and referendums held in the province.

Office of the Premier

In its 2024-25 budget, the party states that it has allocated $1.7 million to provide administrative support for the operation of the Office of the Premier.

Intergovernmental Relations

The party’s 2024-25 budget proposes allocation of:

– $2.0 million for corporate services, including human resources, information technology, performance evaluation and continuous improvement for the Department of the Environment and Local Government.

– $184 thousand to provide funding programs targeted at community infrastructure.

– $20.9 million for development of community services and programs in unincorporated rural areas, to provide consistent application of procedures and ensure uniform community relations across the province.

– $73.4 million to local governments for community funding under An Act Respecting Community Funding.

– $3.0 million to provide leadership, guidance, support and liaison function with local governments, the New Brunswick Society for the Prevention of Cruelty to Animals (NBSPCA) and the Business Improvement Areas (BIAs).

– $5.8 million to provide leadership and support for local governments, rural districts and regional service commissions following the implementation of local governance reform. Both leadership and professional support continue to be provided in the areas of finances, budgets, human resources, planning, and project management to ensure a smooth transition for the new entities as they continue on a path to becoming vibrant and sustainable communities working together to enhance the quality of life of New Brunswickers. In addition, responsible for the implementation of future phases of Reform.

Transportation and Infrastructure

The party’s 2024-25 budget proposes allocation of:

– $396.5 million for the Department of Transportation and Infrastructure, including:

– $187.4 million for ongoing and winter highway maintenance.

– $153.2 provincial building maintenance.

– $31.5 million for bridge and highway construction, including $28.1 million for the New Brunswick Highway Corporation.

Courts & Public Safety

Safe communities

With its 2024-25 budget, the party states that:

– with population growth comes increased demands on public safety services, said Steeves. To address these pressures, $6.6 million will be invested to address increased demands for driver testing and inspection and enforcement services, and to accommodate increased court caseloads and inmate population, along with $5.3 million to help make communities safer.

– additional investments in the province’s justice system are meant to improve access, reduce wait times and provide faster accountability.

Points to Ponder: Good Government

Consider discussing the following with your local candidates, elected representatives, and the parties, and discussing with your family, friends, neighbors, coworkers, and fellow parishioners:

The Role and Purpose of Government

Catholics have definite ideas about the purpose of life and, arising from that purpose, the proper roles of civil society, government, and other social institutions.

- Are those ideas shared by most Canadians? If not, to what extent can or should we share our ideas with other Canadians?

- Are any values held in common by most Canadians? If so, what are they, and how do they inform the proper role of government and other social institutions? For example, what do we owe each other, and what does the answer mean for government, charities, schools, etc.?

- Is it important for a society to share common values? How can common values be promoted within a society?

The Government of Canada has recently published a Framework for Quality of Life (https://www160.statcan.gc.ca/infosheet-infofiche-eng.htm), and has instructed its ministers that “Across our work, we remain committed to ensuring that public policies are informed and developed through an intersectional lens, including applying frameworks such as Gender-based Analysis Plus (GBA Plus) and the quality of life indicators in decision-making.”

- To what extent is the Quality of Life framework consistent with the principles and values of Catholic social teaching?

- To what extent does, or should, a Quality of Life framework apply to provincial governance as well we federal?

Truth, Respect & Good Governance

Each of the mandate letters used by the federal government to instruct its ministers at the time the current government assumed office explained that: “Canadians expect us to work hard, speak truthfully and be committed to advancing their interests and aspirations. When we make mistakes – as we all will – Canadians expect us to acknowledge them, and most importantly, to learn from them.”

- Has this standard been applied to provincial government in New Brunswick?

- To the extent it has not, what can or should New Brunswick voters do to encourage their governments to apply it?

It is an unfortunate and nearly universal practice for our political parties, in framing their platforms and policy statements, to focus at least as much on what’s wrong with the other parties as they do on what’s right about themselves.

- How can we, as citizens and voters, help encourage parties to look for common ground, speak positively and constructively about one another, and voice their suggestions for improvement in respectful and collaborative terms?

- How can we, as individuals, parishes, and as a Church, encourage responsible individuals to consider and accept political vocations in pursuit of truth, justice, and the common good? What roles can or should local, provincial, and federal governments play in promoting such callings?

Democratic Reform

Canada and many of its provinces have long debated the advantages and disadvantages of first-past-the-post vs. proportional voting schemes.

- Should such systems be considered in New Brunswick? If so, what form should they take? Are the people of New Brunswick over or under-represented by the number of elected officials serving them?

- How can we, as individuals, parishes, and as a Church, encourage responsible individuals to consider and accept political vocations in pursuit of truth, justice, and the common good? What roles can or should local, provincial, and federal governments play in promoting such callings?

It is very often the case that party members and candidates – including particularly rank-and-file members and their staff members – are very good people, who sacrifice much in order to contribute to a better world. And it seems too seldom that we thank them, or have anything other than criticism to offer.

What can we, as individuals, do to thank and support such selfless people?

Contracting; Public – Private Partnerships

Contracting and cooperation between government and corporations or other private entities can be instrumental in accomplishing great common projects. On the other hand, unwatched they can become instruments of misuse.

- To what extent should public-private partnerships be allowed, for research, infrastructure development, or other purposes?

- What type(s) of entities should be considered when contemplating such partnerships? Local or foreign corporations? Non-profit or charitable organizations?

- How should such partnerships be monitored or regulated, in order to assure that arms-length relationships are maintained, and that principles of subsidiarity are respected?

Fiscal Responsibility

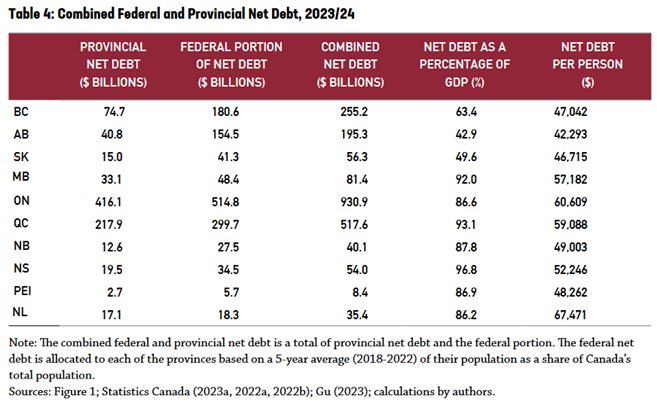

The table below is taken from the report The Growing Debt Burden from Canadians: 2024 edition (©2024 Fraser Institute; https://www.fraserinstitute.org/sites/default/files/growing-debt-burden-for-canadians-2024.pdf). The report shows provincial and federal debts following the 2023/24 fiscal year, and suggests that between provincial and federal debt, taxpayers in New Brunswick would appear to be liable for a debt of just of $49,000 per provincial resident, to be repaid at some future point as directed by the government.

- What do these figures tell New Brunswick citizens?

- Should voters or taxpayers be concerned? If so, what can or should they do about it?

Should future generations of voters, taxpayers, or citizens be concerned? If so, what can or should they do about it?